All Categories

Featured

Table of Contents

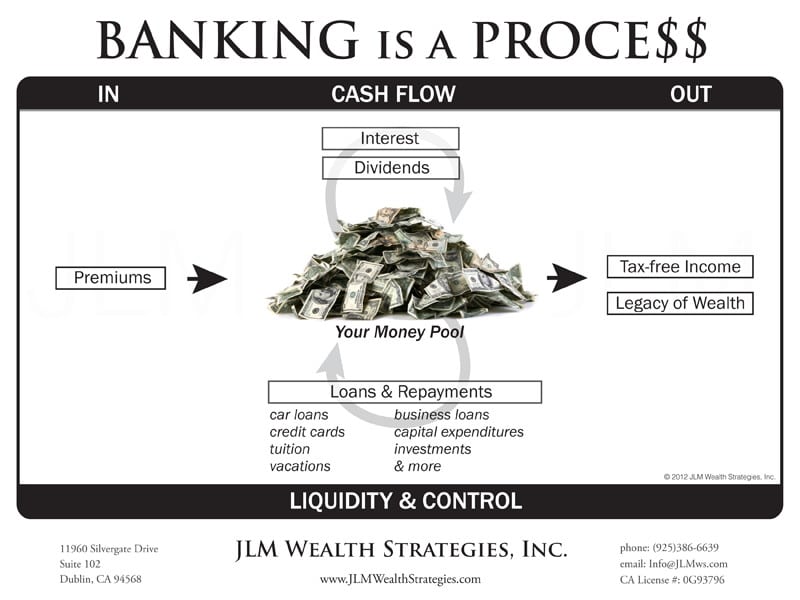

Think of having that passion come back to in a tax-favorable account control. What chances could you benefit from in your life with also half of that money back? The keynote behind the Infinite Financial Principle, or IBC, is for individuals to take more control over the financing and financial functions in their everyday lives.

By having your dollar do more than one job. Currently, when you invest $1, it does one point for you. Maybe it pays an expense.

It can do absolutely nothing else for you. But suppose there was a method that shows people how they can have their $1 do than one task merely by moving it via an asset that they regulate? And what if this method was available to the day-to-day person? This is the significance of the Infinite Banking Concept, initially championed by Nelson Nash in his book Becoming Your Own Lender.

In his book he demonstrates that by developing your own personal "financial system" with a particularly developed life insurance policy contract, and running your bucks through this system, you can considerably enhance your monetary situation. At its core, the concept is as straightforward as that. Creating your IBC system can be carried out in a range of imaginative means without changing your capital.

It takes time to expand a system to take care of everything we want it to do. Just keep in mind that you will certainly be in economic circumstance 10, 20 or even 30 years from now.

The repayments that would have otherwise gone to a banking organization are paid back to your individual swimming pool that would have been made use of. More money goes right into your system, and each dollar is executing multiple jobs.

Cash Value Life Insurance Infinite Banking

This money can be utilized tax-free. The cash you make use of can be paid back at your leisure with no set settlement schedule.

This is just how family members hand down systems of wealth that allow the future generation to follow their desires, start organizations, and make use of opportunities without losing it all to estate and estate tax. Corporations and financial organizations use this approach to create working swimming pools of resources for their businesses.

Walt Disney utilized this method to begin his desire of developing a theme park for youngsters. An audio financial option that does not rely on a rising and fall market? To have cash for emergency situations and possibilities?

Join one of our webinars, or attend an IBC boot camp, all for free. At no cost to you, we will educate you much more concerning exactly how IBC works, and create with you a strategy that works to solve your trouble. There is no commitment at any type of factor at the same time.

Infinite Banking Concept Wikipedia

This is life. This is tradition. Get in touch with one of our IBC Coaches immediately so we can show you the power of IBC and whole life insurance policy today. ( 888) 439-0777.

We've been aiding families, organization proprietors, and people take control of their finances for several years (infinite bank statements). Today, we're delighted to revisit the fundamental principles of the Infinite Banking Concept. Whether you're handling personal financial resources, running a service, or intending for the future, this principle gives a powerful tool to achieve economic objectives

An usual mistaken belief is that boundless banking focuses on getting life insurance coverage, yet it's really about controlling the procedure of financing in your life. Nelson Nash, in his publication Becoming Your Own Lender, makes this clear. The core concept is that we fund every little thing we buyeither by borrowing money and paying passion to somebody else, or by paying money and losing on the rate of interest we might have gained elsewhere.

Some may claim they have an "unlimited financial policy," but that's a misnomer. There's no such point. While specific policies are made to execute the Infinite Financial Principle, Nelson uncovered this procedure making use of a standard entire life insurance plan he had bought back in 1958. Quick ahead to the very early 1980s: rate of interest skyrocketed from around 8.5% to over 20%, and Nelson faced huge passion repayments$50,000 to $60,000 on a commercial car loan.

Nelson received a declaration for his State Farm life insurance plan. He observed that for a $389 costs, the cash worth of the policy would certainly increase by virtually $1,600.

This would certainly guarantee that when home loan rates spiked, the rise in money worth would help cover the added cost. This understanding marked the genesis of the Infinite Financial Idea. It's a tale that resonates to this particular day. Many individuals remain at the grace of rising and fall interest prices on mortgages, home equity lines of credit rating, or company fundings.

Nelson Nash Bank On Yourself

Nelson purchased his plan for its fatality benefit. Over time, the money value grew, creating an economic source he might touch right into through plan fundings. His history as a forester offered him an unique long-lasting viewpoint; he thought in terms of years and generations.

Nelson was spending in a policy that wouldn't have money value for two or 3 years. This brings us to the significance of the Infinite Banking Concept: it's regarding just how you utilize your money.

With your very own pool of cash, the possibilities are endless. This means valuing your cash the very same method a financial institution worths theirs.

When financial institution lendings were at 2-3%, some picked not to borrow against their plans. As financial institution prices climbed to 8-10% while plan fundings continued to be at 5%, those with foresight and a well-structured policy appreciated the liberty to borrow on more favorable terms.

Notably, boundless banking does not need way of life sacrifices. It's concerning making smarter choices with the cash you currently invest.

At its core, limitless financial enables one to utilize one's cash money worth inside their entire life insurance plan instead of relying on standard financing from financial institutions or various other financial institutions. "Insurance policy," in this situation, normally refers to, which covers an individual's entire life (in contrast to, which only covers the insurance policy holder's recipients in the event of fatality).

Be Your Own Bank

Insurance firms normally process such demands easily because the collateral is already in their hands. They can conveniently seize it if the insurance policy holder defaults on their repayments. Most importantly, the system presents significant tax obligation financial savings since rewards from cash-value life insurance policy policies are not subject to revenue tax obligation.

Latest Posts

Whole Life Insurance Infinite Banking

How To Be Your Own Bank In Just 4 Steps

Infinite Banking Explained